schedule c tax form h&r block

Estates and trusts enter on. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Why You Should Do Taxes By Hand At Least Once Money

Yet the average IRS refund was 2763.

:max_bytes(150000):strip_icc()/Form8880.ScreenShot2022-07-05at12.02.49PM-ef2c8c7c2181487fba28a314c04900db.jpg)

. Youll receive a 1099-NEC nonemployee compensation for income you receive for contract labor or self-employment. Prepare And File Your Taxes Online Or In-Office With The Help Expertise Of HR Block. Subtract the total of your returns and allowances from your total sales for the year.

You may also need Form 4562 to claim depreciation or Form 8829 to claim actual expenses from business use of your homepn More Help With Small Business Taxes And Filing IRS Schedule Ch2n. Form 1040-NR line 13 and on. Your HR Block tax professional can help you investigate the cause of your CP2000 notice and communicate with the IRS.

How to get expert help. Doing your taxes is never easy but for small business owners there are some extra layers of complexity. TurboTax Has Simple Step-By-Step Instructions To Help Along The Way.

Get help from a trusted professional at HR Block. HR Block has been approved by the California Tax Education Council to offer The HR Block Income Tax Course CTEC 1040-QE-2355 which fulfills the 60-hour qualifying education requirement imposed by the State of California to become a tax preparer. All investment is at risk.

If youve ever downloaded a tax form. Ad Access IRS Tax Forms. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Fast easy free federal filing for everyone. Sole proprietorships and single-member LLCs file Schedule C to report business net profit or loss. Federal filing is always free for everyone.

Non-refundable tax credits are used to reduce your federal or provincialterritorial taxes payable to zero however if you do not have any tax payable you cannot use them to create a refund meaning you must have an income to benefit. CTEC 1040-QE-2355 2020 HRB Tax Group Inc. Your Schedule1 tax form is used to claim your non-refundable tax credits and calculate your tax payable.

Ad You Can Do It. Business tax forms like. Form 1041 line 3.

Whether its reporting health insurance coverage for your household and the amounts or healthcare tax credits or deductions healthcare and taxes go hand in hand. Your loss may be limited. File a 1040 Schedule C to the IRS online.

Get Ready for Tax Season. Find powerful content for schedule c tax form. Expires January 31 2021.

If you work for more than one company youll receive a 1099 tax form from each company. HR Block has been approved by the California Tax Education Council to offer The HR Block Income Tax Course CTEC 1040-QE-2355 which fulfills the 60-hour qualifying education requirement imposed by the State of California to become a tax preparer. CTEC 1040-QE-2355 2020 HRB Tax Group Inc.

Form 1040 Schedule 3 Additional Credits and Payments Form 1040-ES Estimated Tax Form 1040-V Payment Voucher Form 1040X Amended US. For those using it command over the Schedule C is an important part of making sure they are compliant with federal regulations and not paying more in taxes than. In this post well outline the.

Ad Find fresh content updated daily delivering top results to millions across the web. Complete IRS Tax Forms Online or Print Government Tax Documents. Cost of goods sold.

March 29 2021. Follow these 9 steps to filling out and filing Schedule C. HR Block Online Federal Forms Tax Year 2021.

Expires January 31 2021. Individual Income Tax Return Form 1095-A. Schedule C is a tax form that some small business proprietors use to file their tax returns each year.

If you e-file your tax return youll need to mail a copy of Form 1098-C to the IRS along with Form 8453 after you e-file or include Form 1098-C as a PDF. Answer Simple Questions About Your Life And We Do The Rest. If you checked 32b you.

Your gross salesreceipts goes on Line 1Give the dollar amount for all productsservices you sold. Schedule c tax form hr block Saturday April 2 2022 Edit. Returns and Allowances include cash or credit refunds you make to customers or price reductions on productsservices.

The New 1040 Form For 2018 H R Block Long story short the profit or loss you make on your business flows through is reported. Complete Edit or Print Tax Forms Instantly. Prior to tax year 2020 this information was reported on Form 1099-MISC with Box 7 checked.

Schedule 1 Form 1040 or 1040-SR line 3 or. Schedule SE line 2. Make an appointment for a free consultation with a.

Ad File your 1040 with a Schedule C for free. While you dont naturally think taxes and healthcare are intertwined believe it or not they are. Required documentation The charitable organization should send you Copy B of Form 1098-C or other statement with the same information within 30 days of the vehicle donation or sale.

Start Filing For Free Now. Usually people who file a Schedule C Tax Form will also have to file a Schedule SE Tax Formu00a0 Self-Employment Taxa. If you checked the box on line 1 see the line 31 instructions.

/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

Form 1040 Sr U S Tax Return For Seniors Definition

H R Block Prices Updated For 2021

Keeping Up With Receipts Keep Your Tax Accountant Happy

Recovery Rebate Credit H R Block

Child Tax Credit Schedule 8812 H R Block

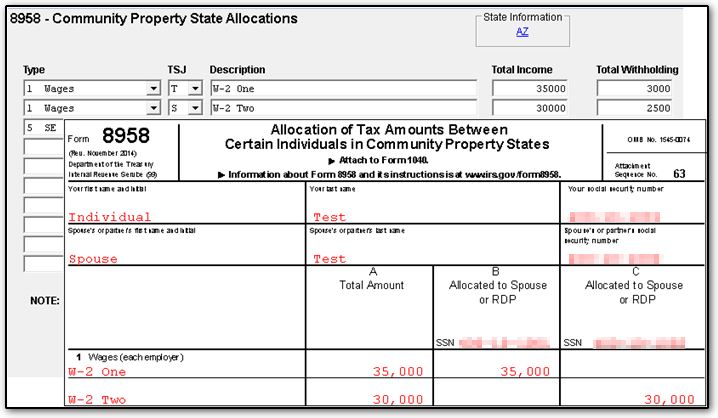

1040 Splitting A Community Property Return

Issues Over Marymount Tax Forms The Monitor

Defense Finance And Accounting Service Civilianemployees Civilian Permanent Change Of Station Pcs Civilian Pcs Entitlement Guide Relocation Income Tax Allowance Rita

:max_bytes(150000):strip_icc()/Form8880.ScreenShot2022-07-05at12.02.49PM-ef2c8c7c2181487fba28a314c04900db.jpg)

Form 8880 Credit For Qualified Retirement Savings Contributions

/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

Form 1040 Sr U S Tax Return For Seniors Definition

Schedule 8812 What Is Irs Form Schedule 8812 Filing Instructions

/Form8880.ScreenShot2022-07-05at12.02.49PM-ef2c8c7c2181487fba28a314c04900db.jpg)

Form 8880 Credit For Qualified Retirement Savings Contributions

What Is Ss 4 Tax Form H R Block

:max_bytes(150000):strip_icc()/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

Form 1040 Sr U S Tax Return For Seniors Definition

Defense Finance And Accounting Service Civilianemployees Civilian Permanent Change Of Station Pcs Civilian Pcs Entitlement Guide Relocation Income Tax Allowance Rita